Best Forex Trading Software: Maximizing Your Trading Potential

In the rapidly evolving world of finance, forex trading software https://exbroker-argentina.com/ has become an indispensable tool for forex traders. The right software not only ensures accuracy in trading but also enhances decision-making capabilities, providing traders with a competitive advantage. This article delves into the essentials of forex trading software, examines popular platforms, and offers tips for selecting the best tools to maximize your trading potential.

Understanding Forex Trading Software

Forex trading software refers to tools and platforms that facilitate the buying and selling of currencies. These applications provide various functionalities such as market analysis, charting tools, and trading execution. They are essential for both beginners and experienced traders who want to streamline their trading activities and minimize risks.

Types of Forex Trading Software

1. Trading Platforms

Trading platforms are the main interface through which traders execute their trades. They provide real-time data, tools for analysis, and options for trading various currency pairs. The most widely used platforms include:

- MetaTrader 4 (MT4): Highly popular among retail traders, MT4 offers a user-friendly interface, advanced charting capabilities, and a variety of technical analysis tools.

- MetaTrader 5 (MT5): An upgrade from MT4, MT5 supports more order types, additional timeframes, and improved analytical features, making it suitable for seasoned traders.

- cTrader: Known for its intuitive design, cTrader is popular among Forex traders for its advanced trading features and fast execution.

2. Automated Trading Software

Automated trading software, often referred to as trading robots or Expert Advisors (EAs), uses algorithms to execute trades on behalf of the trader. This can be particularly beneficial for those unable to monitor the markets continuously. However, it’s essential to backtest these systems thoroughly to ensure their reliability.

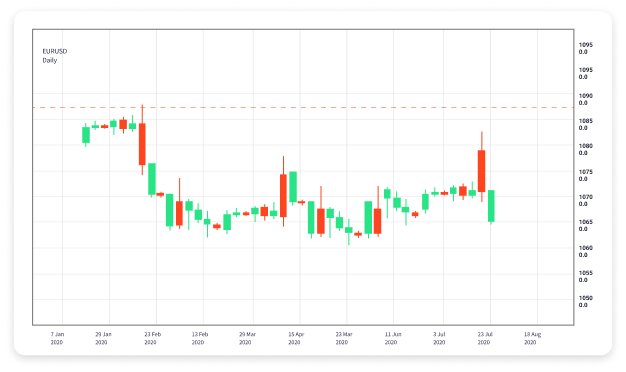

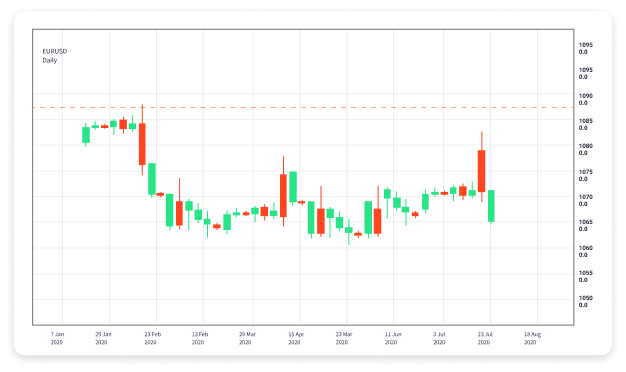

3. Charting Software

Charting software is used for technical analysis, enabling traders to visualize price movements and identify trends. These applications often include various indicators and drawing tools to assist traders in making informed decisions. Some platforms have built-in charting capabilities, but standalone charting software is also available.

4. Risk Management Software

Risk management is crucial in forex trading. Specialized software can help traders analyze potential risks and set parameters to minimize losses. Features might include stop-loss orders, take-profit levels, and exposure calculators, ensuring traders maintain discipline and protect their capital.

Key Features to Consider When Choosing Forex Trading Software

Selecting the right forex trading software involves considering various factors. Here are some essential features to look for:

- User-Friendly Interface: A clean and intuitive interface allows traders of all levels to navigate the platform efficiently.

- Speed and Reliability: Quick execution of trades is crucial in forex trading. Choose software known for its reliability, particularly during high volatility periods.

- Analytical Tools: Access to comprehensive analytical tools, including indicators, oscillators, and chart patterns, can aid significantly in making informed trading decisions.

- Customization Options: Traders often have unique strategies. Look for software that allows customization so you can tailor it to suit your trading style.

- Mobile Compatibility: In today’s fast-paced environment, being able to trade on-the-go through mobile applications is a significant advantage.

Popular Forex Trading Software in 2023

Each year, new forex trading software emerges, while existing platforms continue to evolve. Here are some of the most popular choices among traders in 2023:

- Interactive Brokers: Known for its extensive resources and competitive pricing, Interactive Brokers offers a robust trading platform catering to both novice and experienced traders.

- eToro: This social trading platform allows traders to mimic the strategies of successful peers, making it an excellent choice for beginners looking to learn.

- Thinkorswim: Offered by TD Ameritrade, Thinkorswim is renowned for its advanced charting features and comprehensive educational resources.

Tips for Maximizing Efficiency with Forex Trading Software

Investing in forex trading software is only the first step. To maximize efficiency and effectiveness, consider the following tips:

- Educate Yourself: Take the time to learn all the features of your chosen software. Utilize tutorials, webinars, and educational resources to enhance your understanding.

- Backtest Strategies: Before live trading, backtest your strategies using historical data to evaluate their potential performance.

- Stay Updated: The forex market is constantly changing. Keep abreast of news and updates that may affect currency prices.

- Practice Discipline: Establish clear trading rules and stick to them. Use the risk management tools available in your software to avoid emotional trading decisions.

Conclusion

Forex trading software is a vital component for success in the foreign exchange market. By understanding different types of software, exploring key features, and implementing sound trading practices, traders can significantly enhance their trading experience. Remember that the tools you choose should align with your trading style and goals. With the right software in your toolkit, you’ll be better prepared to navigate the complexities of forex trading.