Mastering Scalp Trading in Forex: Strategies for Success

Scalp trading, a strategy that focuses on making quick profits from small price changes in the forex market, has gained immense popularity among traders looking for rapid returns. Whether you’re a seasoned trader or just starting, understanding the fundamentals of scalp trading can help you navigate the forex market more effectively. For those interested in diverse trading options, consider exploring platforms like scalp trading forex Philippine Trading Platforms for various tools and features that can aid your trading strategies.

What is Scalp Trading?

Scalp trading, or scalping, is a short-term trading strategy that involves making numerous trades throughout the day to capitalize on small price fluctuations. Unlike traditional day trading, which might involve holding positions for hours, scalp traders typically hold positions for seconds or minutes. This method is focused on high volume and lower profit margins on each trade, relying on the sheer number of trades to generate significant returns.

Key Characteristics of Scalp Trading

- High Frequency: Scalp traders execute a large number of trades daily, often in the range of dozens to hundreds.

- Short Holding Period: Positions are held for very short durations, usually just a few minutes.

- Small Profit Margins: The profit target for each trade is modest, often just a few pips, which means strategy and execution are crucial.

- Market Efficiency: Scalping mainly focuses on highly liquid markets, where there is enough volume to ensure quick entry and exit.

Advantages of Scalp Trading

There are several advantages to scalp trading, making it an appealing strategy for many forex traders:

- Quick Profits: The primary advantage is the potential for quick profits, allowing traders to capitalize on small price movements.

- Low Exposure: Due to the short holding period, traders are exposed to less market risk compared to longer-term trades.

- Psychological Comfort: Many traders find the rapid pace of scalp trading to be less stressful than holding positions for a longer time.

- Less Dependence on Market Trends: Scalpers can profit regardless of whether the market is trending upwards or downwards.

Challenges of Scalp Trading

Despite its advantages, scalp trading also presents several challenges:

- Transaction Costs: Frequent trading can lead to high transaction costs that can erode profits.

- Emotional Stress: The fast-paced nature of scalping can lead to emotional strain and decision fatigue.

- Requires Discipline: Success in scalp trading demands immense discipline and focus to stick to a trading plan.

- Not Suitable for Everyone: This method may not be suitable for all traders, particularly those who prefer slower, more analytical trading styles.

Effective Scalping Strategies

To increase your chances of success in scalp trading, various strategies can be employed:

1. Time of Day

The forex market operates 24 hours a day, but not all hours are equally effective for scalping. The best times to scalp are usually during major market sessions, such as overlapping hours between London and New York when liquidity is highest.

2. Use of Indicators

Indicators such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI) can help traders identify entry and exit points more accurately. Combining these indicators with price action can lead to better trading decisions.

3. Proper Money Management

Scalp traders must have a robust money management plan in place. This includes setting stop-loss levels, determining the appropriate trade size, and deciding on acceptable loss limits to protect their trading capital.

4. Choosing the Right Broker

Working with a broker that offers low spreads and commissions is essential for scalp trading, as it directly impacts profit margins. Ensure that your broker provides a fast execution speed and a reliable trading platform.

Tools for Scalping

Successful scalpers rely on various tools to enhance their trading performance:

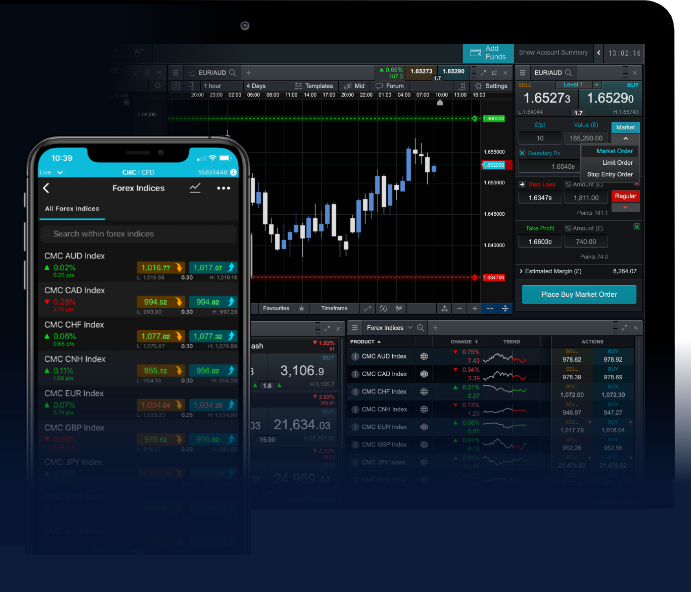

- Trading Platforms: Use advanced trading platforms that offer fast execution, customizable charts, and real-time data.

- Charting Software: Utilize software that provides comprehensive analytical tools to identify market trends and price movements.

- News Feed: Stay updated on market news as major economic announcements can influence currency pairs significantly.

Final Thoughts

Scalp trading in forex is an exciting but often challenging strategy that requires a solid understanding of the market and effective techniques. While it can be highly lucrative, it’s crucial to approach this method with a well-thought-out strategy, discipline, and the right tools. Always remember to test your strategies on a demo account before risking real capital. With practice and patience, scalp trading can become a valuable component of your overall trading portfolio.