Mastering Forex Trading Systems: Strategies for Success

In the ever-evolving world of currency trading, having a well-structured forex trading system is crucial for achieving long-term success. Traders often find themselves overwhelmed by the vast array of options available, making it essential to narrow down effective approaches that align with individual trading styles and financial goals. One valuable resource for aspiring traders is forex trading systems fxtrading-broker.com, which offers insights and tools for navigating the forex landscape.

Understanding Forex Trading Systems

Forex trading systems can be defined as a collection of trading strategies, rules, and techniques designed to maximize profits and minimize risks in the currency markets. These systems can range from simple rules of thumb to complex algorithms powered by advanced technology. The right system can help traders navigate the forex market, identify trading opportunities, and manage risk effectively.

Types of Forex Trading Systems

There are several different types of forex trading systems that traders can explore. Each has its unique characteristics and potential benefits:

1. Automated Trading Systems

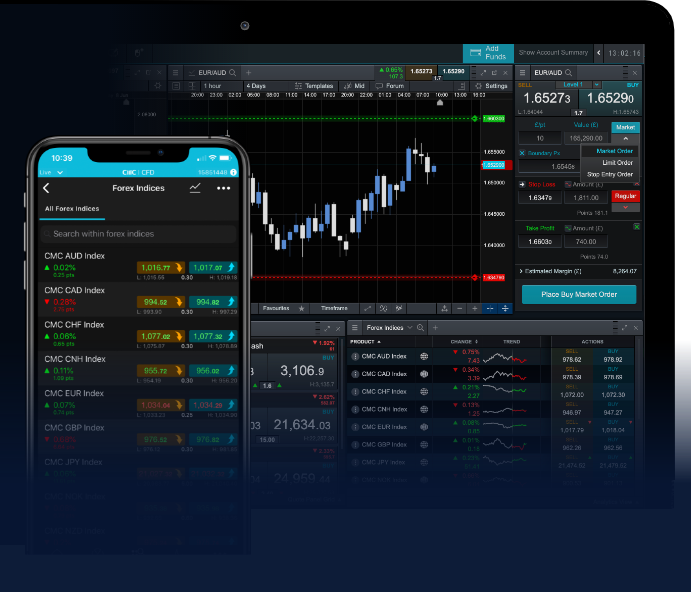

Automated trading involves using software to execute trades based on predetermined criteria. These systems can analyze markets faster than human traders and remove emotional decision-making from the equation. While automation can lead to efficient trading, it’s essential to regularly monitor and adjust algorithms to account for market changes.

2. Trend Following Systems

Trend following systems are predicated on the idea that prices move in trends over time. Traders utilizing this system aim to identify and follow these trends as they occur. This method often involves using indicators such as moving averages or momentum indicators to determine the appropriate entry and exit points for trades.

3. Range Trading Systems

Range trading systems are based on the identification of market ranges where currency pairs trade within established support and resistance levels. Traders buy near support levels and sell near resistance levels, capitalizing on price fluctuations within these ranges. This system is particularly effective in sideways markets.

4. Scalping Systems

Scalping involves making numerous trades throughout the day to capture small price movements. Scalpers look for high liquidity and low spreads, using quick decision-making and rapid execution of trades. Scalping can be rewarding but requires intense focus and quick reactions.

5. Fundamental Trading Systems

While technical analysis is a cornerstone of many trading systems, fundamental trading focuses on understanding economic indicators, geopolitical events, and other news that can impact currency values. Traders operating within this framework analyze macroeconomic data to make informed decisions about when to enter or exit trades.

Choosing the Right Trading System

Selecting the right trading system is a personal decision influenced by various factors, including risk tolerance, trading style, and market conditions. Here are some critical considerations:

1. Define Your Goals

Before diving into the selection of a forex trading system, define your goals clearly. Are you looking for short-term gains, long-term investments, or more consistent income? Your objectives will shape the type of trading system that is best suited for you.

2. Assess Your Risk Tolerance

Every trader has a unique risk tolerance. It’s vital to be honest with yourself about how much risk you are willing to take. This understanding will guide you in choosing a trading system that aligns with your comfort level.

3. Test Different Systems

Once you have an idea of your goals and risk tolerance, it’s prudent to test different systems using demo accounts. This practice will help you gain firsthand experience without risking real capital. Make note of what works best for you and adjust your approach accordingly.

Risk Management in Forex Trading

Regardless of the trading system you choose, risk management is paramount. Successful traders employ strategies such as:

1. Setting Stop-Loss Orders

Setting stop-loss orders can protect your capital from significant losses by automatically closing your position when a currency pair reaches a designated price.

2. Position Sizing

Proper position sizing helps ensure that no single trade can significantly impact your account. This method involves calculating how much to trade based on your overall account balance and risk tolerance.

3. Diversifying Your Trades

Diversification across different currency pairs can mitigate the risks associated with any single trade. By spreading your investments, you can reduce volatility and improve overall performance.

Trading Psychology: An Often Overlooked Factor

Successful trading isn’t just about executing a system; psychological factors play a significant role. Emotional states such as greed and fear can lead to impulsive decisions that undermine a trader’s system. Developing a disciplined mindset and sticking to your trading plan, even in the face of losses, is essential for maintaining consistency and achieving long-term success.

Conclusion

In conclusion, mastering forex trading systems requires a combination of knowledge, discipline, and adaptability. By understanding the various types of trading systems available and tailoring one to your individual needs, you can navigate the currency markets more effectively. Remember to emphasize risk management and improve your trading psychology. With dedication and practice, you can enhance your trading strategies and work towards achieving your financial goals in the forex market.